The 2025 Real Estate Report

Experts Predict Home Values to Increase 1.5% to 3.6% in 2025.

Top housing experts and economists give a glimpse of what mortgage rates, home values and the national real estate market will do in 2025.

Key Takeaways

- Mortgages are forecasted to remain higher for longer; but there are things you can do to lower your rate.

- Home values are predicted to increase incrementally on a national level; and there are projects you can do to increase your home’s value.

- The national market will slightly favor sellers in negotiations; however, real estate is driven by local dynamics and may favor either buyers or sellers.

Note: real estate is a dynamic market and forecasts made in this article will change as the year unfolds.

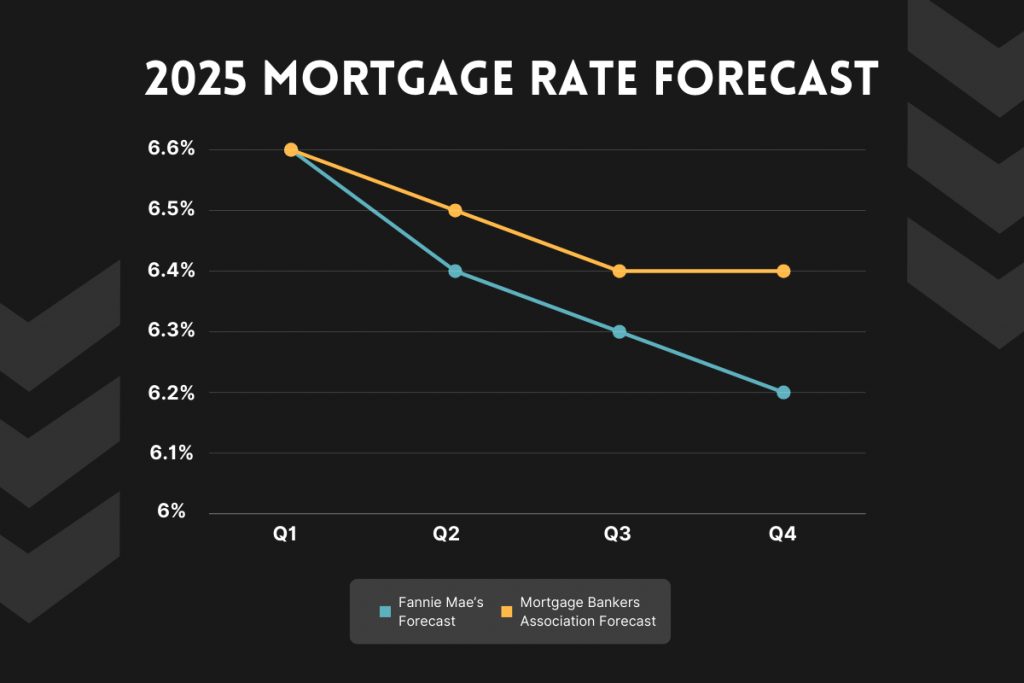

Mortgage Rates Will Average 6.4% in 2025

In 2023, the average 30-year mortgage peaked at 7.79% following the pandemic. Rates came down from that peak in 2024. What will mortgage rates do in the next year?

The Federal Reserve is predicted to lower the federal funds rate 6 to 8 times in 2025; but mortgage rates are not set by the Federal Reserve and may not drop significantly (National Association of REALTORS®).

Fannie Mae predicts mortgage rates to average 6.4% in 2025. Mortgage Bankers Association also predicts mortgage rates to average 6.4%, but with slightly higher rates compared to Fannie’s forecast.

Sources: Fannie Mae Housing Forecast: November 2024 andMortgage Bankers Association Mortgage Finance Forecast: November 2024

Sources: Fannie Mae Housing Forecast: November 2024 andMortgage Bankers Association Mortgage Finance Forecast: November 2024

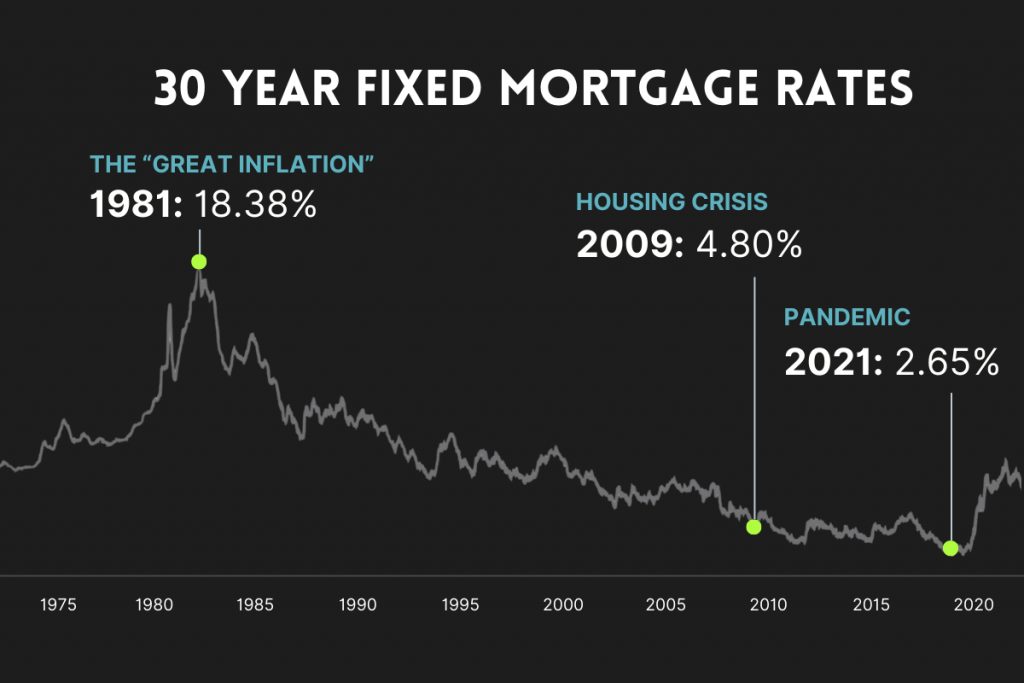

When Will Mortgage Rates Drop Back to 3%?

Historically, rates have never been as low as the pandemic era interest rates. 30-Year mortgage rates averaged between 4% and 6% during & after the housing crisis and Great Recession. A return to a 3% range is very unlikely.

Source: Federal Reserve of St. Louis

Source: Federal Reserve of St. Louis

Tips to get a better mortgage rate…

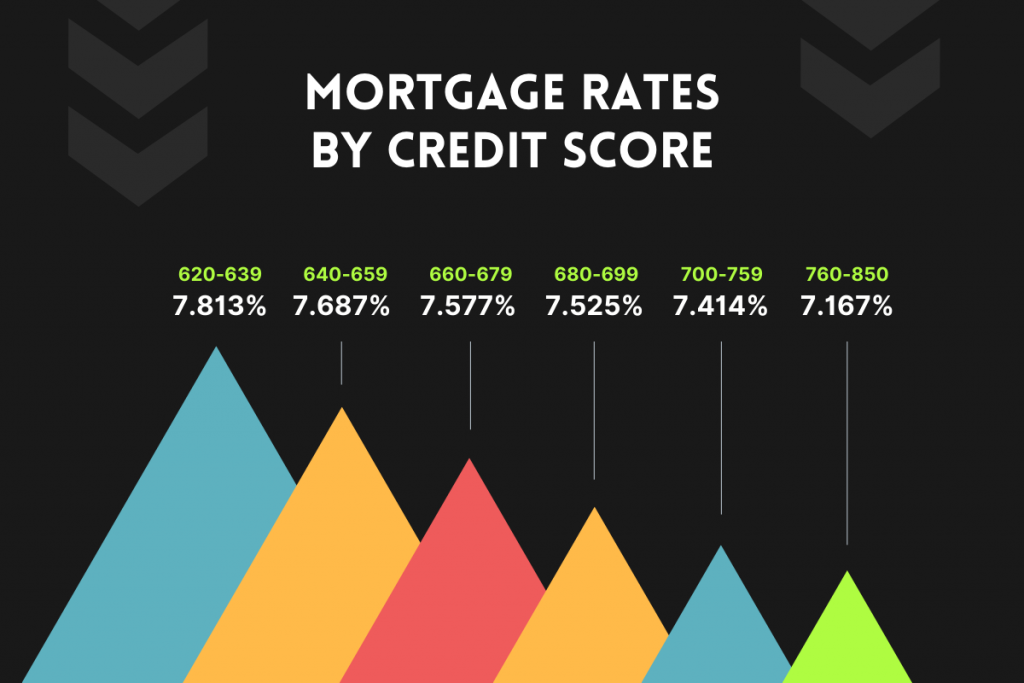

While we can’t affect the average 30 year mortgage rate, you can improve your credit and get the best possible rate. Here’s an example of recent mortgage rates by credit score:

Source: myFICO.com

If you’re thinking of making a move, the earlier you talk to a mortgage finance professional, the more time you have to work on improving your credit to get a better rate.

Need a recommendation to a trusted lender? Send me a message.

Source: myFICO.com

If you’re thinking of making a move, the earlier you talk to a mortgage finance professional, the more time you have to work on improving your credit to get a better rate.

Need a recommendation to a trusted lender? Send me a message.

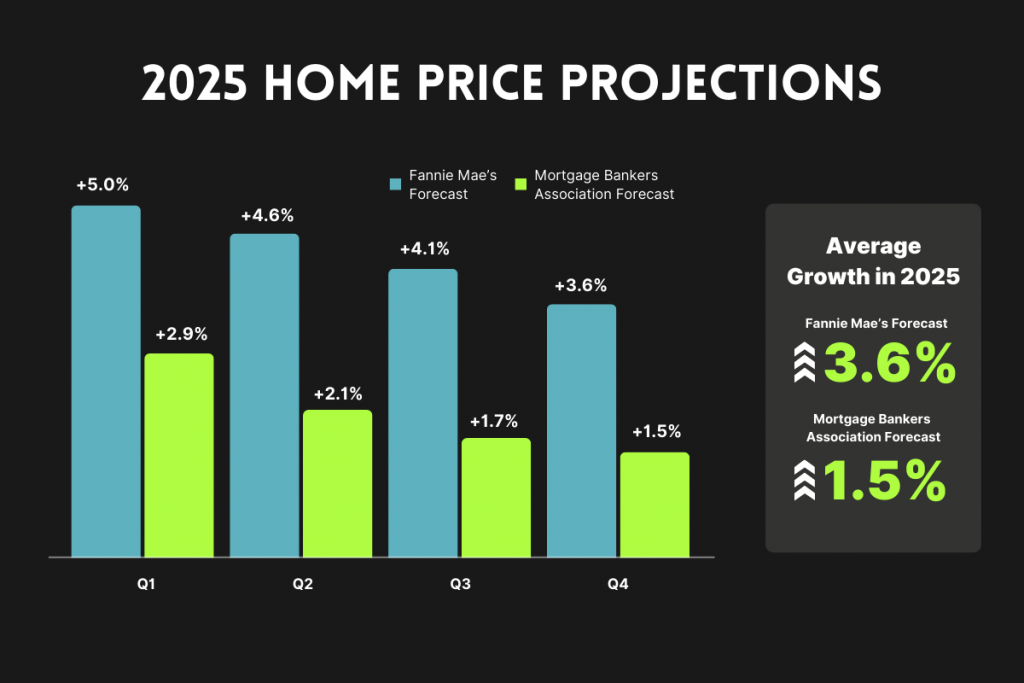

Home Values Will Increase by 1.5% to 3.6%

Since 2020, the average sales price of a home has gone up by $97,000 or 29.7% (Federal Reserve of St. Louis). Which indicates homeownership to be a great investment. But, what will home values do in the next year?

On a national level, home price growth is predicted to slow down from 2024. However, home prices are predicted to increase in 2025. Fannie Mae predicts home prices to increase on average by 3.6%. MBA is predicting an average increase of 1.5%.

Sources: Fannie Mae Housing Forecast: November 2024 and Mortgage Bankers Association Mortgage Finance Forecast: November 2024

Home values are influenced by local market dynamics. If you want to understand what home values are forecasted to do locally, consider talking to a real estate professional.

Want to increase your home’s value? Consider these remodeling projects for the highest return on investment.

Sources: Fannie Mae Housing Forecast: November 2024 and Mortgage Bankers Association Mortgage Finance Forecast: November 2024

Home values are influenced by local market dynamics. If you want to understand what home values are forecasted to do locally, consider talking to a real estate professional.

Want to increase your home’s value? Consider these remodeling projects for the highest return on investment.

Will Home Values Crash in 2025?

For home values to drop significantly, a major influx of homes for sale would have to hit the market. Freddie Mac estimates the U.S. housing stock is 3.7 million units below what’s needed to meet demand. It will take time to build up inventory to meet demand. Which is why a major drop in home values and prices is unlikely.

Will 2025 Be a Home Buyers or Sellers Market?

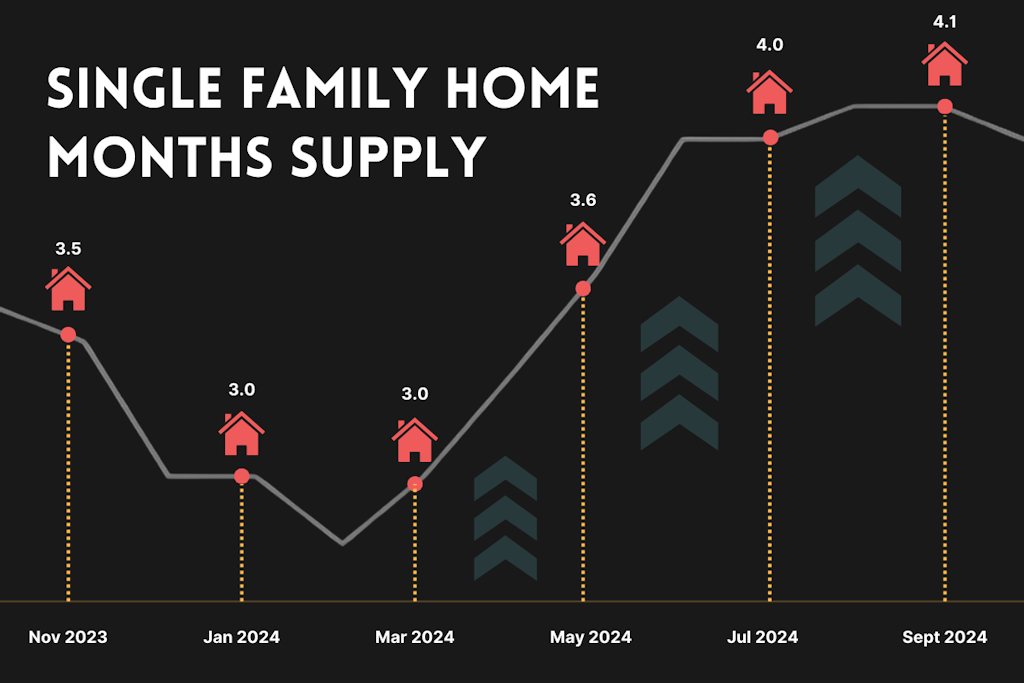

Who will have the advantage in the 2025 housing market, buyers or sellers? One measure of the market is Months Supply and it shows who has the advantage.

Months Supply is calculated by dividing the total number of homes for sale by the average number of homes sold each month. For example if there are 500 homes for sale in a particular area and an average of 100 homes are selling each month, the Months Supply is 5 months.

Here’s a chart of month’s supply going back to November of 2023:

Source: Federal Reserve of St. Louis

6 Months Supply is considered a balanced market. Over 6 months supply is considered a buyers’ market. Below 6 months supply is a sellers’ market. At 4 months supply on a national level, the market slightly favors sellers.

Inventory is rising nationally, however, which could shift the market to favor buyers in the next year. With that said, all real estate is local and local markets will differ in favoring buyers versus sellers.

If you want to know if your area favors buyers or sellers, send me a message.

Source: Federal Reserve of St. Louis

6 Months Supply is considered a balanced market. Over 6 months supply is considered a buyers’ market. Below 6 months supply is a sellers’ market. At 4 months supply on a national level, the market slightly favors sellers.

Inventory is rising nationally, however, which could shift the market to favor buyers in the next year. With that said, all real estate is local and local markets will differ in favoring buyers versus sellers.

If you want to know if your area favors buyers or sellers, send me a message.

What This Means for Homeowners

If you own a home, you will likely see a slight increase in your home’s value. If you want to increase your home’s value and enjoy the upgrades, consider making some home improvements. If you want advice on which features or projects are best suited for increasing your home’s value, consult with a professional.

Tips for Potential Home Buyers

If you’re thinking of purchasing a home, the sooner you start planning the better. Knowing your price range, optimizing your credit, and working towards your downpayment are steps you can take now. Even if you’re in the market to buy in the next 12 to 24 months, talking with a real estate professional early in the process will set you up for success.

Tips for Potential Home Sellers

Sellers need to prioritize their objectives. Is getting top dollar for your home the highest priority, is it moving within a specific timeframe? Do you have to sell a home prior to purchasing your next one? These objectives must be prioritized so that an effective plan and marketing strategy can be put into place. Thinking of making a move? Talk to a real estate professional!